Best High Interest Savings Account 2024 Guide: Find the Best Bank Interest Rate in Singapore!

In an era where savings accounts provide meager interest rates, high interest savings accounts (HISAs) are increasingly becoming appealing options for those looking to grow their money more effectively. This guide aims to simplify the search for the best high interest savings accounts available in Singapore for 2024, comparing rates and features to help you make an informed decision.

Understanding High Interest Savings Accounts

High interest savings accounts are designed to offer a higher interest rate than traditional savings accounts. This can significantly enhance your savings potential over time, making them ideal for short- to medium-term savings goals. Factors to consider when assessing these accounts include the interest rate, fees, minimum balance requirements, and additional benefits such as bonus rates tied to certain conditions.

Why Choose a High Interest Savings Account?

The primary advantage of choosing a high interest savings account is the potential for greater interest accrual. While typical savings accounts earn minimal interest, high interest options can yield rates upwards of 2% or more annually. This is particularly beneficial in combating inflation, as it helps maintain the purchasing power of your savings. Additionally, HISAs often come with features that promote saving, such as round-up programs and rewards for maintaining a balance.

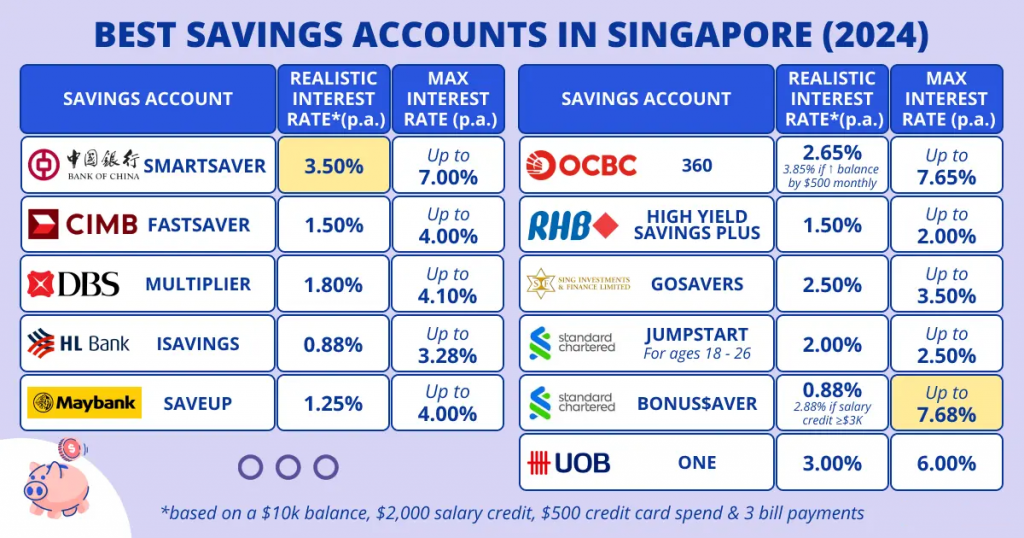

Best High Interest Savings Accounts in Singapore for 2024

1. DBS Multiplier Account

The DBS Multiplier Account is well-known for offering competitive interest rates that can reach up to 3.5% per annum. To earn these higher rates, you must meet certain criteria, including making transactions such as crediting your salary, paying bills, or making insurance and investment purchases through the bank. With no monthly maintenance fees and the convenience of online banking, the DBS Multiplier is popular among many Singaporeans.

2. OCBC 360 Account

The OCBC 360 Account can offer interest rates of up to 2.4% per annum. This account provides additional bonuses based on your monthly transactions, such as crediting your salary or spending on an OCBC credit card. There are also options to boost your interest further through achieving specific goals such as setting up regular savings or investment plans. This account is suitable for individuals looking to actively engage in their banking activities.

3. UOB Stash Account

The UOB Stash Account offers a straightforward interest rate structure, with potential earnings of up to 2.5% per annum. One unique feature of the Stash account is its tiered interest rate system where you can earn higher rates simply by maintaining different levels of account balances. It encourages savers to keep higher balances while allowing withdrawals without impacting the interest earned.

4. Citi MaxGain Account

For those looking for flexibility, the Citi MaxGain Account offers a unique approach to savings. While it is considered a hybrid account that combines savings with a line of credit, customers can enjoy an interest rate of up to 2.3% per annum. The interest rate is dependent on maintaining specific minimum balances, making it crucial to manage your funds effectively. This account is particularly advantageous for those who might require quick access to funds while still earning interest.

5. HSBC EasiSave Account

The HSBC EasiSave Account is designed for effortless savings, offering an interest rate of up to 1.5% per annum. The account features a user-friendly application process and offers digital banking capabilities. Additionally, there are no minimum balance requirements allowing you to save flexibly without the pressure of maintaining a specific sum.

Keys to Maximizing Interest Earnings

To best benefit from high interest savings accounts, consider the following strategies:

- Understand Requirements: Many HISAs offer higher rates conditional upon certain activities. Familiarize yourself with these requirements to ensure you meet them and maximize your returns.

- Maintain a Healthy Balance: Consider the minimum balance requirements of various accounts. Often, maintaining a higher balance leads to increased interest earnings.

- Utilize Online Tools: Most banks provide online calculators to help you understand how much interest you could earn based on your starting balance and contributions. Engage with these tools to set realistic savings goals.

- Compare Regularly: Interest rates can change, and promotional offers may arise. Regularly reviewing your options can ensure you’re always benefiting from the best rates available.

Factors to Consider When Choosing an Account

When selecting a high interest savings account, there are several essential factors to consider:

- Interest Rates: Look beyond the introductory rates; understand the terms and how you can maintain those higher rates.

- Fees: Assess any maintenance fees that could eat into your savings. Some accounts offer zero fees for maintaining a minimum balance.

- Accessibility: Ensure that the account allows easy access to your funds, so you won’t face penalties or difficulties withdrawing when necessary.

- Banking Features: Evaluate whether the account comes with additional features such as mobile banking, linked investments, or other perks beneficial for you.

Conclusion

As you plan your financial journey for 2024, considering high interest savings accounts as part of your strategy can significantly enhance your savings potential. By understanding the market offerings and effectively managing your account, you can work towards securing your financial future while enjoying the benefits of increased interest earnings.

Always remember to conduct thorough research and evaluate what best suits your financial situation and goals, ensuring you choose a bank and account that align with your long-term aspirations.