A Singaporean Stocks Investor (AK) Shares His Portfolio And Advice For Investors

In the vibrant landscape of Singapore’s financial market, many investors have embarked on journeys filled with successes and challenges. One such investor is AK, a seasoned stock market enthusiast whose approach to building a diverse portfolio has garnered interest from both novice and seasoned investors alike.

In this section, AK shares his perspective on investing in Singaporean stocks, detailing his own portfolio and offering valuable advice for others looking to navigate the dynamic stock market.

What percentage of your monthly income do you invest?

I am retired and currently not drawing any monthly income. I saved most of my earned income when I was working, and of which I invested most of it for income whenever “Mr. Market” was feeling depressed at different times.

What do you look for when choosing the right instrument to invest in?

As I invest mostly for income, my main consideration when choosing the stocks to invest in is the company’s ability and willingness to pay meaningful dividends.

” Income investing refers to a strategy where investors can obtain income from their portfolio. Income from this portfolio is achieved without having to touch their initial capital through selling shares. In this case, we can see that AK focuses a lot of the dividends the companies he invested in is paying.” – Seedly

Understanding AK’s Investment Philosophy

AK’s investment philosophy centres around a few core principles: long-term value, diversification, and the importance of ongoing education. He believes that successful investing is not just about making a quick profit, but rather about understanding the underlying value of the companies one invests in. For AK, the goal is to build wealth over time through informed decision-making and patience. This belief has guided his investment choices and has played a significant role in his overall strategy.

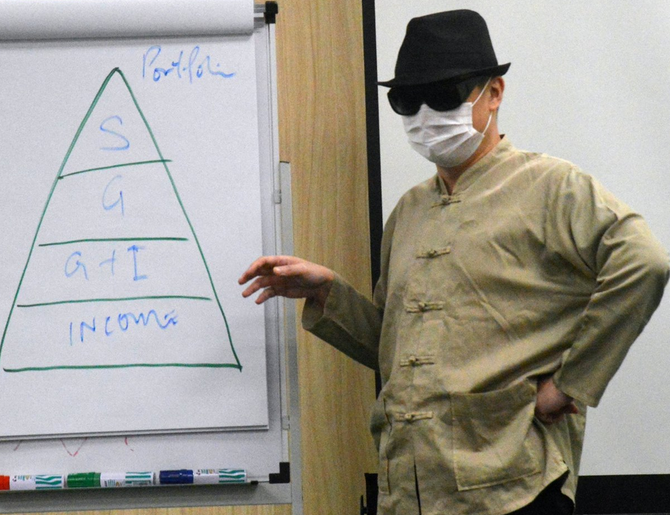

AK’s Portfolio Breakdown

AK’s portfolio is a representation of his thoughtful approach to investing. It includes a mix of individual stocks, ETFs, and REITs, each selected based on thorough research and analysis.

1. Individual Stocks

A significant portion of AK’s investments is allocated to blue-chip stocks listed on the Singapore Exchange (SGX). These companies, known for their stability and consistent performance, provide a solid foundation for his portfolio. AK highlights some of his top picks, which include:

- DBS Group Holdings: As one of the largest banks in Singapore, DBS has shown resilience through varying economic conditions. With consistent dividend payouts and strong fundamentals, AK sees this stock as a cornerstone of his portfolio.

- Singapore Telecommunications Limited (Singtel): This telecom giant has a diversified business model, encompassing mobile, digital, and fixed services. AK appreciates Singtel’s potential for growth in the digital space, making it a valuable addition.

- CapitaLand Integrated Commercial Trust: As one of Singapore’s leading REITs, CapitaLand offers a way to invest in real estate while providing attractive dividends. AK is drawn to its robust portfolio of commercial properties, positioning it well for long-term income generation.

2. Exchange-Traded Funds (ETFs)

To further diversify his investments, AK has also included several ETFs in his portfolio. These funds allow him to gain exposure to broader market trends without the need to pick individual stocks. Some of his preferred ETFs include:

- SPDR Straits Times Index ETF (STI ETF): This ETF tracks the performance of the Straits Times Index, which consists of the top 30 companies listed on the SGX. AK views this as a low-cost way to invest in the overall performance of the Singaporean market.

- Nikko AM Singapore STI ETF: Similar to the SPDR STI ETF, this fund offers another avenue for investing in Singapore’s leading companies. AK appreciates the simplicity and liquidity of these ETFs for both new and experienced investors.

3. Real Estate Investment Trusts (REITs)

Understanding the integral role of real estate in wealth building, AK allocates a portion of his portfolio to various REITs. These trusts provide him with regular income through dividends while also offering potential for capital appreciation. Some of his favourites include:

- Ascendas Real Estate Investment Trust: Focusing on business and logistics properties, Ascendas REIT has a solid track record of delivering growth. AK admires its ability to adapt to changing market needs, especially with the rise of e-commerce.

- Frasers Logistics & Commercial Trust: This REIT focuses on logistics and industry properties across Australia and Europe. AK values its strategic approach to property acquisition and management, viewing it as a steady income generator.

Key Investment Strategies from AK

AK’s investing journey is not without its lessons. Here are some of the key strategies he shares based on his experiences:

1. Do Your Own Research

AK emphasizes the importance of conducting thorough research before making any investment decisions. He suggests taking time to understand the company’s fundamentals, market position, and potential growth areas. This not only enhances confidence in your investment choices but also equips investors to weather market fluctuations.

2. Stay Informed About Market Trends

Keeping abreast of local and global economic indicators is crucial. AK encourages investors to follow financial news, economic reports, and developments relevant to their investments. This insight enables informed decision-making and timely adjustments to one’s portfolio.

3. Embrace Volatility

Market fluctuations can be unsettling, but AK views them as opportunities. He advocates for a long-term perspective, suggesting that temporary downturns can present buying opportunities for solid companies. His philosophy revolves around staying the course during market challenges rather than succumbing to panic selling.

4. Utilize a Dollar-Cost Averaging Strategy

To manage risk, AK employs a dollar-cost averaging strategy, investing a fixed amount regularly regardless of market conditions. This disciplined approach mitigates the impact of market volatility and lowers the average cost of investment over time.

5. Diversification is Key

One of AK’s paramount strategies is diversification. By allocating investments across different sectors and asset classes, he reduces risk and increases potential returns. This strategy allows him to maintain stability even during turbulent market periods.

Conclusion

Through AK’s insights and experiences, we glimpse the journey of a dedicated investor navigating the complexities of the Singaporean stock market. His emphasis on research, diversification, and a patient outlook reflects a well-rounded approach to investing that many can learn from. As the Singaporean market continues to evolve, investors like AK stand testament to the opportunities that diligent investing can provide for wealth accumulation and financial independence. With his strategies as a guide, both new and seasoned investors can embark on their own paths toward successful investing in Singapore.