Immediate Avapro 500 vs Instant Max AI

When considering automated financial tools, both Immediate Avapro 500 and Instant Max AI present unique features aimed at enhancing user experience and investment management. Below, we compare these two options side by side, highlighting their strengths and weaknesses to help you make an informed decision.

1. Immediate Avapro 500

- User Interface: Immediate Avapro 500 boasts a user-friendly interface that simplifies navigation for users of all levels. The dashboard provides a clear overview of investments and performance metrics.

- Investment Strategy: This tool employs a more conservative investment strategy, focusing on long-term growth and stability. Ideal for users looking to generate consistent returns without excessive risk.

- Customer Support: Immediate Avapro 500 provides 24/7 customer support, enabling users to seek assistance at any time, which can be crucial for quick decision-making.

- Fees: The platform charges a small management fee, which may be appealing for those prioritising reliability over cost.

2. Instant Max AI

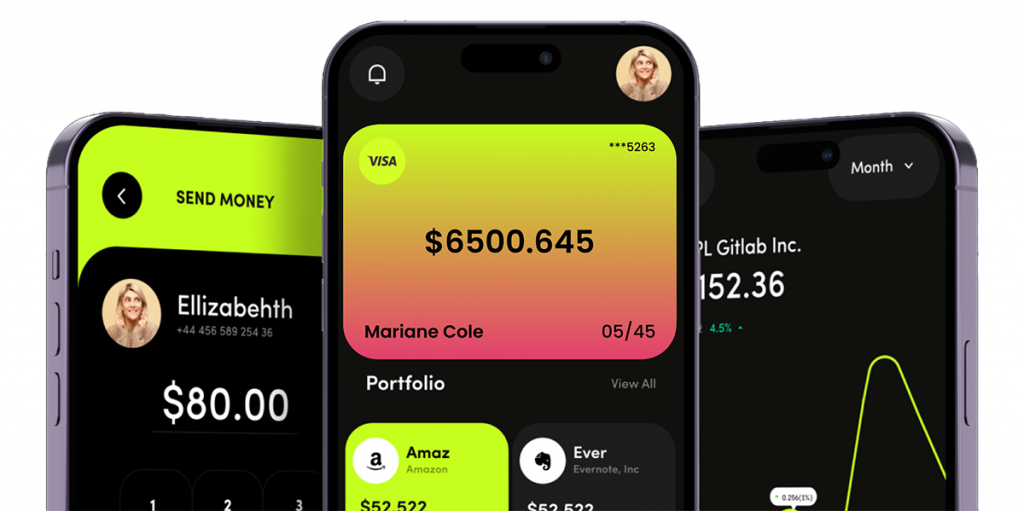

- User Interface: Instant Max AI features a sleek and modern interface that integrates advanced technologies, making it desirable for tech-savvy investors. Its dashboards are highly customizable.

- Investment Strategy: Unlike Immediate Avapro 500, Instant Max AI utilizes aggressive trading techniques, deploying algorithms for real-time market analysis to capitalise on short-term opportunities. Best suited for users willing to accept higher volatility in exchange for potential higher returns.

- Customer Support: The customer support experience may vary, as Instant Max AI relies more on automated systems like chatbots. This could lead to longer wait times for complex inquiries.

- Fees: While Instant Max AI offers competitive rates, the fees may be slightly higher due to the advanced trading features and technology involved.

While both Immediate Avapro 500 and Instant Max AI offer valuable features to investors, there are several reasons one might argue that Immediate Avapro 500 is the less effective choice compared to Instant Max AI. This analysis delves into the strengths of Instant Max AI, considering factors such as investment strategy, technology integration, adaptability, and user engagement, which collectively may present a stronger case for the latter.

1. Investment Strategy Comparison

Immediate Avapro 500 employs a conservative investment strategy that prioritizes long-term stability and less volatility. While this may appeal to risk-averse investors, it may also limit profit potential. In contrast, Instant Max AI showcases a more aggressive approach by utilising advanced algorithms designed to exploit short-term market fluctuations. This strategy could attract investors looking for higher returns, as it adapts to changing market conditions in real-time.

While a steady growth trajectory feels secure, some investors find that it does not match the rapid pace of technological advances in the investment landscape, potentially leaving Immediate Avapro 500 users behind in terms of maximising their financial gains.

2. Technology Integration

The rapidly evolving nature of financial technology is reshaping how investors manage their portfolios. Instant Max AI stands out by adopting cutting-edge technology to enhance investment decisions. Its reliance on artificial intelligence allows for the analysis of vast amounts of data and executing trades almost instantaneously. This technological edge enables it to stay ahead of market trends, providing users with timely insights that can lead to higher yields.

Conversely, Immediate Avapro 500, while user-friendly, does not leverage such advanced technology to the same extent. Its relatively straightforward systems may lack the sophisticated tools necessary for maximizing profit in a fast-paced investment environment. Investors seeking a competitive advantage may find that Immediate Avapro 500 does not satisfy their need for technologically-driven insights.

3. Customization and Flexibility

Customization is a crucial aspect of modern investment tools. Instant Max AI excels in offering users the ability to tailor their dashboards and investment strategies to suit their preferences and risk tolerance. This bespoke approach empowers users to engage actively with their investments and adapt their strategies as market conditions evolve.

In contrast, Immediate Avapro 500’s relatively rigid structure can restrict investors. While it provides essential information, this lack of customization may lead to frustration as users find it challenging to adjust their strategies to align with their changing financial goals. The ability to modify one’s approach is paramount in today’s dynamic market—something where Immediate Avapro 500 might fall short.

4. Customer Support Quality

Customer support plays an essential role in an investor’s experience. Instant Max AI relies on automated systems like chatbots to handle inquiries, which can streamline the process for straightforward questions. However, this reliance can lead to longer wait times for more complex issues. On the other hand, Immediate Avapro 500 prides itself on its 24/7 customer support, providing users with reassurance that assistance is readily available.

Despite this, when examining overall efficiency, the more extensive reach of Instant Max AI’s automated systems allows it to process larger volumes of inquiries with more speed and less manual intervention. For investors who value quick, easily accessible support and resources, the perceived benefits of Immediate Avapro 500 could be overshadowed by the efficiency of Instant Max AI.

5. Fees and Substantial Returns

Fees are a significant consideration for any investor. Immediate Avapro 500 charges a management fee, which investors may accept given its conservative strategy. However, those focused on maximising returns might see this fee as an unnecessary drain on their profits.

Comparatively, while Instant Max AI operates with slightly higher fees due to its sophisticated features, many users may find that these fees are justified by the potential for significantly greater returns. If an investment tool facilitates higher profit margins, investors may become more inclined to accept these fees, believing them to be a small price to pay for enhanced performance.

6. Investment Education and Engagement

Education plays an integral role in boosting investor confidence and engagement. Instant Max AI often incorporates educational resources aimed at helping users understand market trends and investment strategies. The integration of such educational materials can nurture a more engaged user base, leading to better overall investment outcomes as users become more proficient at managing their portfolios.

In contrast, Immediate Avapro 500 may not provide the same depth of educational resources. While it offers a straightforward interface and user experience, the lack of ongoing learning opportunities may leave users feeling less equipped to make informed decisions. Knowledge is power in the investment world, and Instant Max AI’s commitment to investor education could position it as the more attractive option for those eager to enhance their financial literacy.

7. Market Adaptation and Responsiveness

An effective investment tool must remain responsive to market shifts. Instant Max AI’s use of predictive analytics and real-time data empowers users to adapt their strategies swiftly based on market developments. This agility can signify the difference between capitalizing on an opportunity and missing it altogether.

Immediate Avapro 500 has a slower response mechanism, reliant on a more traditional approach to market analysis. This could leave its users at a disadvantage in a landscape that demands rapid adaptation for optimal performance. The ability to pivot in response to market changes can be a game-changer, and Instant Max AI’s design facilitates this.

Conclusion

Ultimately, the choice between Immediate Avapro 500 and Instant Max AI should align with your personal investment goals, risk tolerance, and desired level of support. For those seeking a steady investment approach with robust customer service, Immediate Avapro 500 may be the ideal fit. Conversely, if you’re drawn to cutting-edge technology and are comfortable with higher risk, Instant Max AI could be the better option for maximising potential gains. Whichever platform you choose, always remember to conduct thorough research and consult with a financial advisor before making any significant investment decisions. So, make sure to consider your personal preferences and goals before selecting the best option for you. Happy investing!

#Disclaimer

The content provided in this document is for informational purposes only and does not constitute financial advice. Always consult with a professional financial advisor before making any investment decisions. We do not endorse or promote any specific companies or tools mentioned in this document.