Ultimate Guide to Stablecoins: USDT vs USDC vs BUSD vs UST vs DAI vs XSGD

In the ever-evolving landscape of cryptocurrencies, stablecoins have emerged as crucial players, providing a bridge between the volatile world of cryptos and the stability of fiat currencies. This comprehensive guide examines the major stablecoins in the market, including Tether (USDT), USD Coin (USDC), Binance USD (BUSD), TerraUSD (UST), DAI, and XSGD, comparing their features, mechanisms, and ideal use cases.

What are Stablecoins?

Stablecoins are a category of cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, typically fiat currencies like the US dollar. This stability makes them ideal for use in payments, remittances, and as a way to protect against the price volatility that characterises Bitcoin and other cryptocurrencies.

Types of Stablecoins

- Fiat-Collateralized Stablecoins: These are backed by a reserve of fiat currency in a bank account. For every stablecoin issued, a corresponding fiat dollar is held in reserve.

- Crypto-Collateralized Stablecoins: These are backed by other cryptocurrencies. Due to the inherent volatility of cryptocurrencies, these stablecoins are often over-collateralized.

- Algorithmic Stablecoins: These do not have collateral backing but use algorithms to control the supply and demand of the stablecoin, maintaining its price stability.

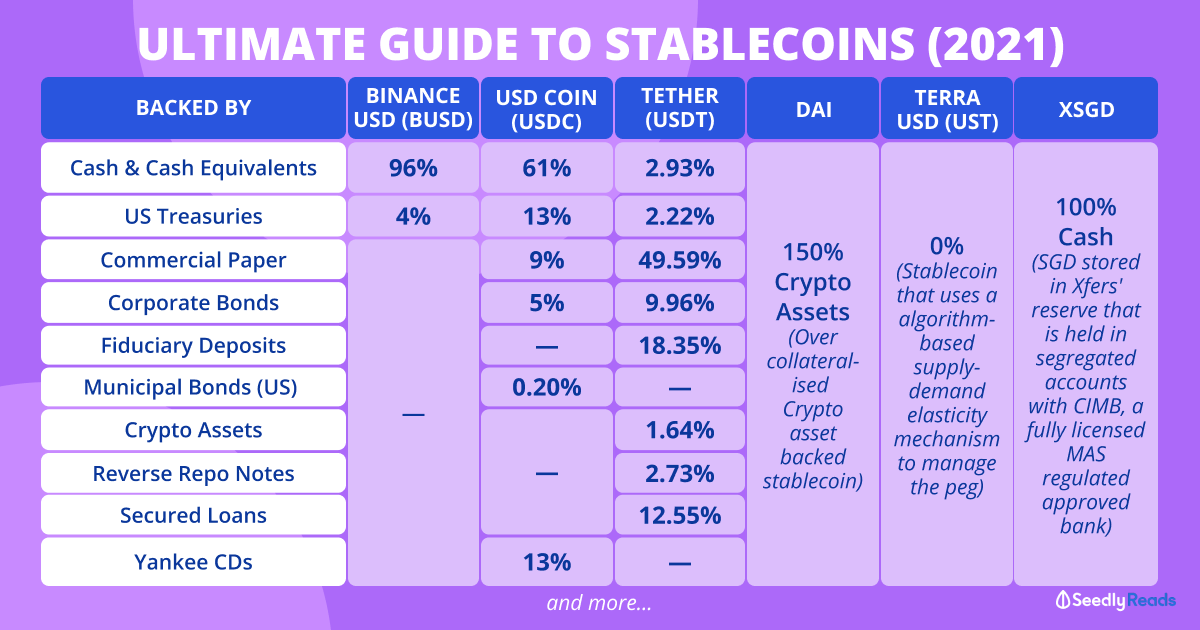

Comparison of Major Stablecoins

1. Tether (USDT)

Overview: Tether (USDT) is the first and most widely used stablecoin. It is pegged to the US dollar, with the goal of maintaining a 1:1 value ratio.

Mechanism: USDT is fiat-collateralized, meaning for every USDT token issued, Tether claims to hold an equivalent amount in cash or cash equivalents.

Ideal Use Cases: USDT is predominantly used for trading on exchanges due to its high liquidity and wide acceptance.

2. USD Coin (USDC)

Overview: USD Coin (USDC) is a stablecoin developed by the Centre consortium, which includes companies like Circle and Coinbase. It is also pegged to the US dollar.

Mechanism: USDC is fiat-collateralized. It is regularly audited, ensuring transparency and that the reserves back every single USDC token in circulation.

Ideal Use Cases: USDC is often chosen for DeFi applications and transparent transactions, appealing to developers looking for regulated stablecoins.

3. Binance USD (BUSD)

Overview: Binance USD (BUSD) is a 1:1 USD-backed stablecoin issued by Binance, one of the largest cryptocurrency exchanges.

Mechanism: Similar to USDC, BUSD is fiat-collateralized, and the reserves are regularly audited by third parties.

Ideal Use Cases: BUSD is primarily used within the Binance ecosystem, providing users with a means to trade and earn interest on their holdings.

4. TerraUSD (UST)

Overview: TerraUSD (UST) is an algorithmic stablecoin that aims to maintain its peg to the US dollar through a unique mechanism involving the Luna token.

Mechanism: UST adjusts supply through smart contracts. When UST is traded or redeemed, it can be converted into Luna, affecting the total supply of UST and stabilizing its value.

Ideal Use Cases: UST is commonly used in the DeFi space, particularly for yield farming and lending.

5. DAI

Overview: DAI is a decentralized, crypto-collateralized stablecoin created by the MakerDAO protocol. It aims to maintain a stable value while being backed by various cryptocurrencies.

Mechanism: DAI is over-collateralized; users deposit cryptocurrencies to mint DAI. If the collateral value fluctuates, it can lead to liquidation, ensuring that DAI retains its peg.

Ideal Use Cases: DAI is favoured for its decentralized nature, making it well-suited for DeFi applications.

6. XSGD

Overview: XSGD is a stablecoin pegged to the Singapore dollar, aimed at providing a digital currency option for the Southeast Asian market.

Mechanism: XSGD is fiat-collateralized, with reserves held in Singapore dollar equivalents.

Ideal Use Cases: XSGD is positioned for remittances and trading within the Singaporean and broader Southeast Asian markets, appealing to local users.

Conclusion

Each stablecoin plays a unique role in the cryptocurrency ecosystem, catering to different needs and preferences. USDT, USDC, and BUSD are excellent for trading and liquidity, while UST and DAI appeal to users looking for decentralized options. XSGD offers a regional solution for users in Asia. By understanding the features and mechanics of these stablecoins, users can make informed decisions that help them navigate the crypto landscape effectively.

Frequently Asked Questions (FAQ)

Stablecoins provide the stability of fiat currency while granting access to the speed and efficiency of cryptocurrency transactions. They help mitigate the volatility associated with traditional cryptocurrencies.

While stablecoins aim to maintain a stable value, their stability can be affected by factors such as market dynamics, regulatory changes, or the mechanisms used to maintain their peg.

Yes, stablecoins can lose their peg due to a lack of trust in the backing assets, liquidity challenges, or inadequate market mechanisms. It’s essential to research the specific stablecoin’s mechanisms before investing.

Stablecoins can be used for a variety of transactions, including online purchases, remittances, investments, or as a means to generate yields in DeFi protocols.

Yes, risks associated with stablecoins include counterparty risk, regulatory risk, and market volatility. Users should perform thorough due diligence prior to engaging with any stablecoin.

Stablecoins can be stored in cryptocurrency wallets, including hardware wallets for enhanced security, or on exchanges where they can be easily traded or used for transactions. Always opt for reputable wallets or platforms to reduce risks.