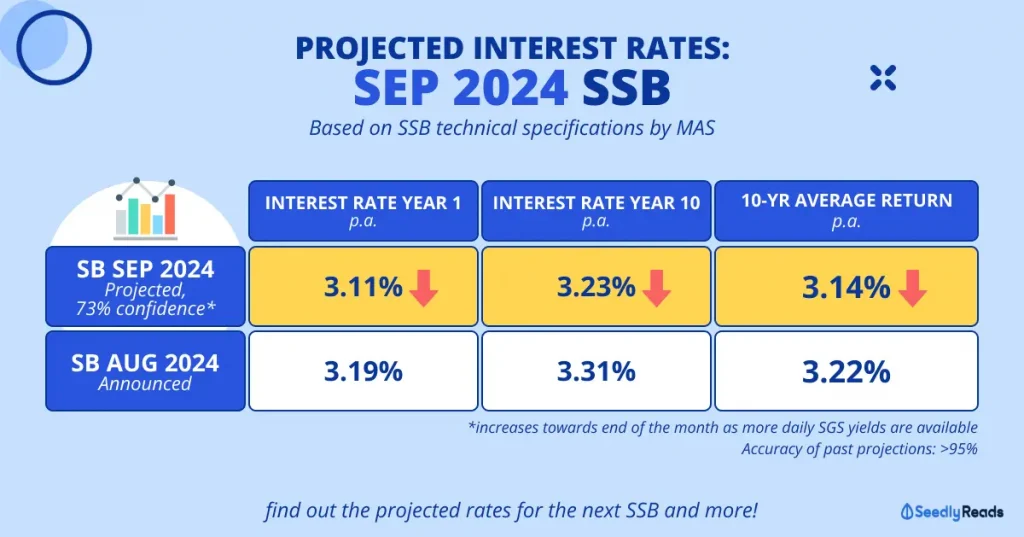

Singapore Savings Bond (SSB) Sep 2024 Interest Rate Projections

The Singapore Savings Bond (SSB) continues to be a popular choice for conservative investors looking for secure, long-term savings options. As we approach September 2024, interest rate projections for the SSB reflect the evolving economic landscape influenced by global market trends and domestic monetary policies. Analysts anticipate that the interest rates for the SSB may increase as the Monetary Authority of Singapore (MAS) adjusts its policies in response to inflationary pressures and changing economic conditions.

Historically, the SSB offers a competitive interest rate, calculated based on the average yield of long-term Singapore government securities. For September 2024, projections suggest that the SSB may offer an interest rate range between 2.5% to 3.0% per annum, depending on market dynamics at the time of issuance. This expected rate, reflective of the ongoing economic recovery and monetary tightening, makes the SSB an attractive investment option for individuals seeking a reliable savings vehicle without the risk of capital loss. Investors should keep a close eye on official announcements from the MAS to accurately gauge the final rates and make informed decisions regarding their savings strategy.

How Can I Use the Singapore Bonds Interest Rate Projections to My Advantage?

Understanding interest rate projections for financial instruments like the Singapore Savings Bond (SSB) can provide strategic insights for investors aiming to enhance their savings and investment outcomes. With projected interest rates between 2.5% to 3.0% per annum for the SSB in September 2024, here are several strategies on how you can leverage this information to optimise your financial decisions.

1. Timing Your Investment

Timing plays a critical role in maximising the returns on your investments. As interest rates are projected to increase, it is prudent to consider the timing of your bond purchases. If you anticipate that rates will continue to rise, investing now could lock in a favourable rate before further increases materialise. Conversely, if rates are nearing their peak, delaying your purchase might be advantageous as you could benefit from higher rates in the near future.

2. Diversifying Your Portfolio

While the SSB offers attractive interest rates, diversification is essential in mitigating risk. Consider allocating a portion of your overall portfolio to bonds, while also investing in different asset classes such as stocks, real estate, or mutual funds. This balanced approach can help cushion your investments against market volatility and provide stable returns over the long term. Use the projected interest rates as a guideline when deciding the proportion of bonds versus other investments in your portfolio.

3. Utilizing Bond Laddering Strategy

A bond laddering strategy entails purchasing bonds that mature at different intervals. This approach allows you to take advantage of rising interest rates while maintaining liquidity. As rates rise, you can reinvest shorter-term bonds into new bonds with higher yields. By using the interest rate projections of the SSB, you can structure your ladder to maximise returns while managing interest rate risk effectively.

4. Assessing Inflation and Real Returns

Understanding the real return on your savings is crucial, especially in an inflationary environment. If you expect inflation to rise, it may erode the purchasing power of your returns. By analysing interest rate projections alongside inflation forecasts, you can better evaluate the attractiveness of returning on the SSB versus other investments. If the real return (interest rate minus inflation) is appealing, increasing your stake in the SSB could be beneficial.

5. Incorporating Automatic Investments

For individuals who prefer a hands-off approach, setting up automatic investments in the SSB can facilitate consistent contributions to your savings. This method helps manage market timing risks and allows you to accumulate bonds over time, potentially benefiting from fluctuations in interest rates. Regular contributions can also leverage dollar-cost averaging, reducing the impact of volatility on your investment.

6. Re-evaluating Your Risk Profile

As you integrate the SSB projections into your investment strategy, revisiting your overall risk tolerance is essential. If you perceive the projected rise in interest rates will favour safer assets, such as the SSB, it may be an opportune time to adjust your portfolio to align with a more conservative risk profile. This could involve reallocating funds from higher-risk investments into safer options that offer stable returns.

7. Planning for Financial Goals

Utilising interest rate projections can aid in effectively planning for your short-term and long-term financial goals. Whether you are saving for a major purchase, retirement, or a child’s education, understanding the SSB rates can help you map out the timeline and the amount you need to save. Setting clear financial objectives and investing in SSBs can lead you closer to achieving these goals while securing a predictable return.

8. Staying Informed and Engaged

Keep yourself informed about economic developments. Inflation rates, central bank policies, and global economic trends can significantly impact interest rate projections. By actively engaging with reliable financial news and resources, you can make timely and informed investment decisions. Being proactive rather than reactive can give you an advantage in your investment journey.

9. Seeking Professional Advice

If you are uncertain about how to incorporate interest rate projections into your financial strategy, consider consulting with a financial advisor. Professional insights can offer tailored advice based on your individual situation and help you make informed decisions regarding your investments, including the optimal timing for purchasing Singapore Savings Bonds.

Conclusion

Using interest rate projections for the Singapore Savings Bond can empower you to make strategic investment decisions that optimise your financial standing. By timing your investments wisely, diversifying your portfolio, and understanding the broader economic implications, you can navigate the complexities of saving and investing effectively. Leverage the projected SSB rates as a component of your comprehensive financial strategy, enabling you to achieve your financial objectives with greater confidence.

The Singapore Savings Bond (SSB) continues to be a popular choice for conservative investors looking for secure, long-term savings options. As we approach September 2024, interest rate projections for the SSB reflect the evolving economic landscape influenced by global market trends and domestic monetary policies. Analysts anticipate that the interest rates for the SSB may increase as the Monetary Authority of Singapore (MAS) adjusts its policies in response to inflationary pressures and changing economic conditions.